New Legislation Reestablishes Pooled Trusts for Seniors Over 65: The Effects of H.5033

On September 6th, 2024, Governor Maura Healey signed the Long-Term Care Bill (H.5033), An Act to Improve Quality and Oversight of Long-Term Care. “The bill is the first step toward addressing the urgent need to reform the state’s long-term care industry, which includes nursing homes, assisted living communities and skilled nursing facilities,” reports MassNAELA. Several pieces of this bill were a top priority in advocacy efforts of The Arc of Bristol County, to ensure the health and well-being of seniors and people with disabilities in Massachusetts.

Read the full MassachusettsNAELA Press Release.

What is a pooled trust?

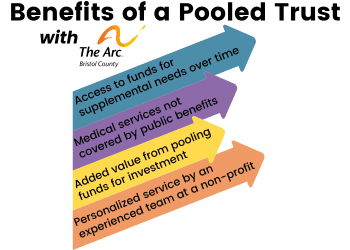

Pooled trusts are designed to benefit the elderly and people with disabilities by protecting their financial assets or unexpected financial gains, while still maintaining eligibility for public benefits. When individuals join a pooled trust their funds are added into one account with funds of all the other trust beneficiaries, offering an opportunity for greater returns on investments. A trust sub-account is created for each beneficiary to manage their funds individually and track any investment gains. Non-profit organizations like The Arc of Bristol County manage the pooled trusts.

When will the new law take effect, and what will it mean for seniors or people aged 65 and over with a disability?

The law, effective December 6th, 2024, ensures that seniors aged 65 and older and people with disabilities can create a sub-account in a pooled trust. This allows them to set aside funds for their supplemental needs without facing penalties from MassHealth and other public benefits. Additionally, this law enacted the estate recovery statute to aid low-income individuals in creating generational wealth.

What are the next steps?

If you are concerned about asset preservation, unexpected financial gains, and planning for the future, please reach out to The Arc of Bristol County and ask to arrange a meeting with Michael Andrade at 508-226-1445 ext. 3108. Additional details are available on our Trust Management page.